“Last month, Philipp Bagus and Andreas Marquart released their new book…”

Source: Our Monetary System Favors the Rich and Hurts the Poor | Mises Wire

“Last month, Philipp Bagus and Andreas Marquart released their new book…”

Source: Our Monetary System Favors the Rich and Hurts the Poor | Mises Wire

“Six Major Events That Will Change History By Egon von Greyerz Investors globally have never faced risk of the magnitude that the we are now exposed to. But sadly very few are aware of the un…”

Source: Six Major Events That Will Change History | GoldSwitzerland

I spent this morning with three of my colleagues visiting the American Museum of Finance on Wall Street, down the street from the NYSE, the Trump building and a couple of blocks form the New York Fed. Last week I joined the AMOF and will organize a trip in September for my Financial History of the US course. I urge you to join at www.moaf.org

Below are some pictures I took inside the museum. If you will be visiting NYC, I highly recommend spending some time viewing the exhibits, which show how American finance was instrumental in creating our prosperity.

How will Ben be remembered? The great statist.

“In the space of a mere eight years, the former US Federal Reserve Bank Chair Ben Bernanke has managed to achieve what Vladimir Lenin could barely conceive.”

Source: Goodbye Lenin, Hello Bernanke

“Max Keiser Financial War Reports”

Source: [KR940] Keiser Report: Gold & World’s Debt Problems | Max Keiser

“One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this…”

Source: Destination Mars | Economic Prism

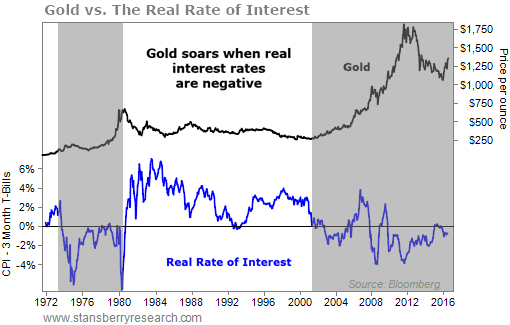

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

In the 1980s and 1990s real interest rates were positive and stock markets were booming, hence gold went nowhere. That alla chnged at the turn of the century.

Central banks’ manipulations are causing enormous distortions in the financial markets and the economy. The next bubble bursting will be HUGE.

“Markets don’t believe the Fed will really raise interest rates this year, but traders may be missing something.”

Source: Here’s how the Fed could surprise you

Will all the Federal Reserve’s money printing lead to big collapse?

Source: Get Ready for Dollar Destruction and the End Game

When will the top occur? The $64,000 question.

Source: Chart Of The Day: Stock Averages Up 3X More Than Nominal GDP Since 2007 Peak

Price inflation is accelerating. Easy money–quantitative easing–is having its effects on prices.

“The Labor Department said Thursday its producer price index for final demand rose 0.5 percent in June, versus analysts’ expectations of 0.3 percent.”

Source: US Producer Price Index up 0.5% in June vs. 0.3% increase expected

Precious metals prices will soar.

“We’re always assessing tools that we could use,” Mester told the ABC’s AM program. “In the US we’ve done quantitative easing and I think that’s proven to be useful. “So it’s my view that [helicopter money] would be sort of the next step if we ever found ourselves in a situation where we wanted to be more accommodative.

Source: Fed’s Mester Says Helicopter Money “The Next Step” In US Monetary Policy