“Rising asset prices stoke worries about bubbles forming.”

Source: Ex-Fed Official, Worried About Bubbles, Warns of U.S. Downturn – Bloomberg

“Rising asset prices stoke worries about bubbles forming.”

Source: Ex-Fed Official, Worried About Bubbles, Warns of U.S. Downturn – Bloomberg

Donald Trump’s acceptance speech at the Republican convention last night could have been a lot shorter and focused on espousing the virtues of limited government and free enterprise.

First, Donald should have used several props, such as the first 1040 form, which was only four pages long. He should have said that a tax return of 1914 was simple and allowed the federal government to raise the funds it needed to pay for its expenses 100 years ago, when only 2% of the American people had to pay any income tax. In addition, today large and medium-sized businesses need an army of accountants and attorneys to comply with the tax code. That’s money that cannot be used to buy better equipment, modernize their factories, and thus make American workers more productive, which would earn them higher salaries.

“John Mauldin, Financial Expert, Best-Selling Author, and Editor of Thoughts from the Frontline Investment Newsletter. Offering Financial & Economic Analysis, Research.”

Source: MauldinEconomics.com

How will Ben be remembered? The great statist.

“In the space of a mere eight years, the former US Federal Reserve Bank Chair Ben Bernanke has managed to achieve what Vladimir Lenin could barely conceive.”

Source: Goodbye Lenin, Hello Bernanke

“Max Keiser Financial War Reports”

Source: [KR940] Keiser Report: Gold & World’s Debt Problems | Max Keiser

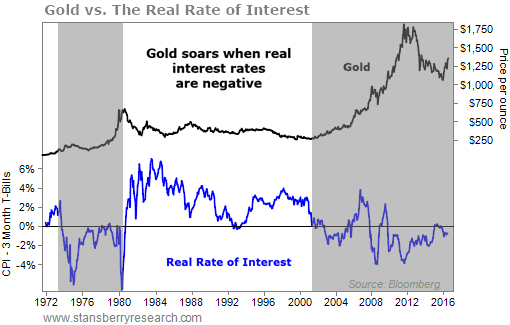

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

Gold is in the second major bull market since President Nixon severed the last link between the dollar and gold on August 1971. With negative interest rates around the world and real interest rates negative, gold will boom, again.

In the 1980s and 1990s real interest rates were positive and stock markets were booming, hence gold went nowhere. That alla chnged at the turn of the century.

Central banks’ manipulations are causing enormous distortions in the financial markets and the economy. The next bubble bursting will be HUGE.

“Markets don’t believe the Fed will really raise interest rates this year, but traders may be missing something.”

Source: Here’s how the Fed could surprise you

Will all the Federal Reserve’s money printing lead to big collapse?

Source: Get Ready for Dollar Destruction and the End Game

Could be worse than the stock market and housing bubbles.

“Sometimes an apt juxtaposition is worth a thousand words, and one from this morning’s news is surely that. Last year Japan lost another 272,000 of its population as it marches resolutely…”

Source: Bubbles In Bond Land——It’s A Mania! | David Stockman’s Contra Corner

Price inflation is accelerating. Easy money–quantitative easing–is having its effects on prices.

“The Labor Department said Thursday its producer price index for final demand rose 0.5 percent in June, versus analysts’ expectations of 0.3 percent.”

Source: US Producer Price Index up 0.5% in June vs. 0.3% increase expected

Looks good for now, but how much longer will stocks keep going up?

Source: Top Three Reasons Why This Rally Won’t Last

Easy money is doing its thing…higher prices are here and may go higher.

“Inflation is creeping higher and will soon force the Federal Reserve to re-examine the wisdom of keeping short-term interest rates low, says economist Paul Ashworth, the winner of the Forecaster of the Month contest for June.”

Source: Inflationary pressures are already building, top forecaster says